child care tax credit calculator

Ad File to Get Your Child Tax Credits. The new system is part of the American Rescue Plan which increased the total credit from 2000 per child in 2020 to 3600 per child under age 6 and 3000 per child.

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

You can use this calculator to see what child.

. The IRS is no longer issuing these advance payments. Child and Dependent Care Credit Value. Discover Helpful Information And Resources On Taxes From AARP.

Use this calculator to find out how much you could get towards approved childcare including. Ad Search Smart - Find Child Care Tax Credit Compare Results. Compare Answers Top Search Results Trending Suggestions.

The maximum child care credit can vary from 1200 to 2100. 3600 for each child under age 6 and 3000 for each child ages 6 to 17. Free childcare for children aged between 2 and 4.

Help with childcare costs if your child is. This percentage varies from 35 if your adjusted gross income is 15000 or less to 20 if your AGI is over 43000. You can get up to 500 every 3 months 2000 a year for each of your children to help with the costs of childcare.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Free means free and IRS e-file is included. The Child and Dependent Care Credit can be worth from 20 to 35 of some or all of the dependent care expenses you paid.

Use our child tax credit calculator to determine your eligibility for tax year 2020 or tax year 2021. As part of the Mental Health Services Act this tax provides funding for mental health programs. The payments for the CCB young child supplement are not reflected in this calculation.

Claim the Tax Refund You Deserve. Claim the Child Tax Credit in 2022 by e-filing your 2021 Tax Return on. Find Child Care Tax Credit.

Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit. Estimate how much tax credit including Working Tax Credit and Child Tax Credit you could get every 4 weeks during this tax year 6 April 2021 to 5 April 2022. Most families will receive the full amount.

How much will I receive in Child Tax Credit payments. For children under 6 the amount jumped to 3600. Max refund is guaranteed and 100 accurate.

Have been a US. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility. Tax credits calculator -.

Technically tax brackets end at 123 and there is a 1 tax on personal income over 1 million. Estimate Your 2021 Child Tax Credit Advance Payments. If you get Tax-Free Childcare the government will pay 2 for every 8 you.

The Child Tax Credit can significantly reduce your tax bill if you meet all seven. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000. Child and family benefits calculator.

The percentage you use.

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

Health Insurance Marketplace Calculator Kff

Who S Eligible For The Child Tax Credit And What It Means This Tax Season Cnet

Canada Child Benefit Increase What Will Your Monthly Ccb Be Planeasy

Daily Cost Of Your Childcare Expenses Calculators Ministere Des Finances

Canada Child Benefit Ccb After Separation No Cra Audit

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Diabetes Disability Tax Credit Jdrf Canada

Manitoba Tax Brackets 2020 Learn The Benefits And Credits

How The 2021 Child Tax Credits Work Updated June 21st 2021 The Learning Experience

What Are Marriage Penalties And Bonuses Tax Policy Center

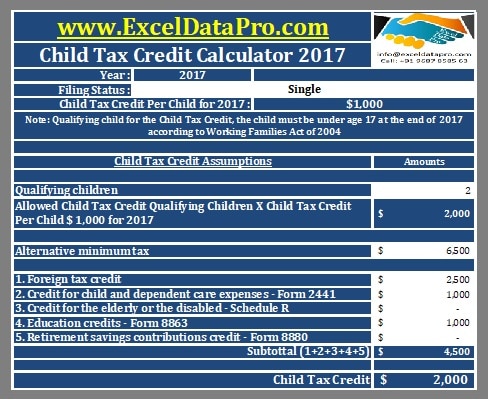

Download Itemized Deductions Calculator Excel Template Exceldatapro

What Is Child Tax Credit Federal Income Tax Return Exceldatapro

Family Tax Deductions What Can I Claim 2022 Turbotax Canada Tips

2021 Health Insurance Marketplace Calculator Kff

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

Taxtips Ca 2021 Non Refundable Personal Tax Credits Base Amounts